![]() Amir Hossein Mahdavi April 19, 2020

Amir Hossein Mahdavi April 19, 2020

How well can Iran’s economy meet the financial drain of the coronavirus pandemic? The only effective way to slow down the spread of the virus is to ground the population–whether by forced quarantine or by a shelter-in-place advisory. But this tactic brings a heavy financial burden. This unexpected expense is an additional strain to the Iranian economy already in tatters due to sanctions, and comes at a time when the price of Iran’s most important export, crude oil, has reached its lowest point in 18 years. Last spring, a flood obliterated 1% of Iran’s gross domestic product equivalent to one year of the country’s development budget, further exacerbating the situation.

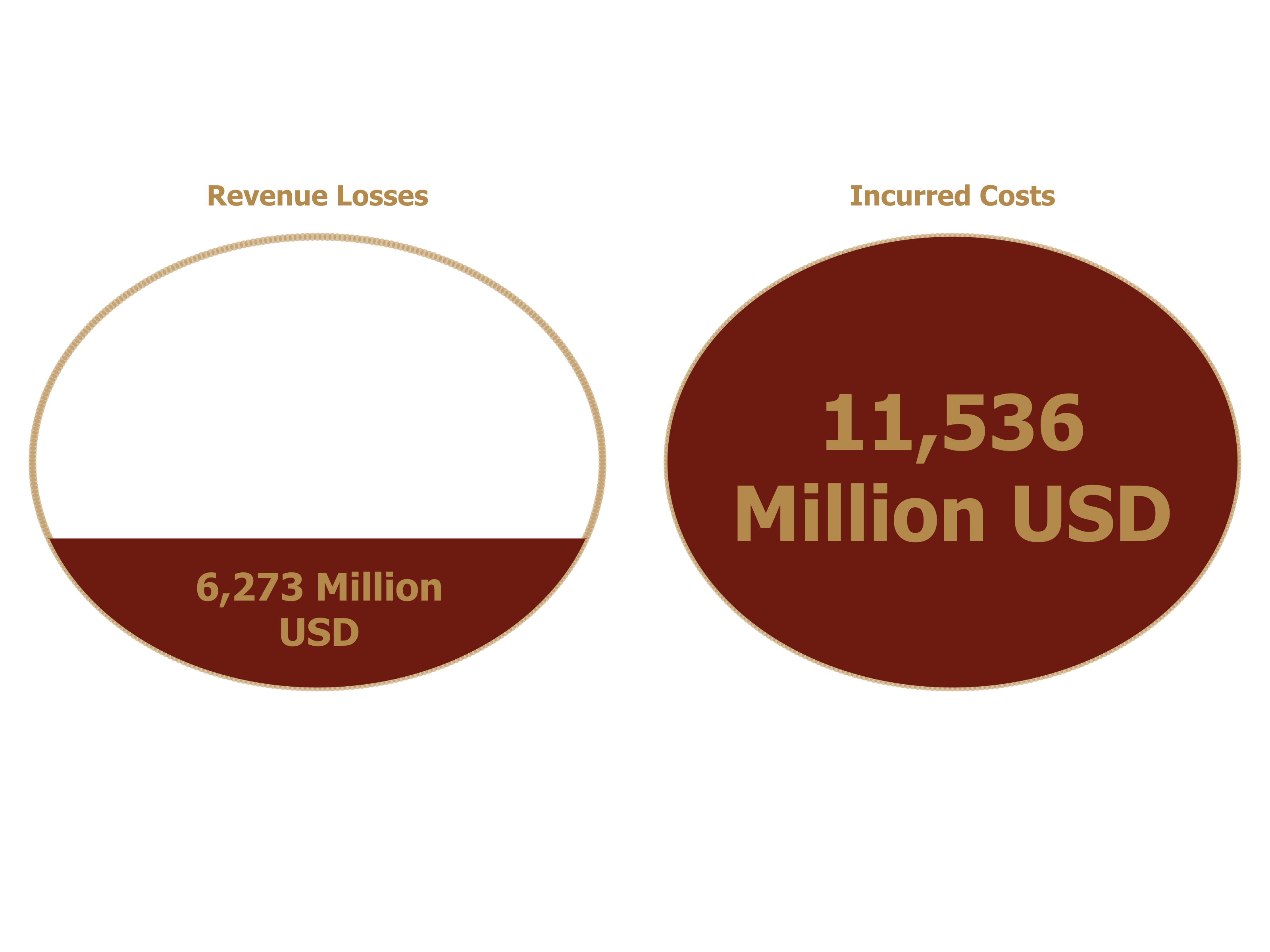

When the coronavirus crisis began to unfold, Iran was already dealing with the worst stagflation in two decades. Over the course of one year, prices increased by 35% and the Iranian economy shrank by 8%. Without taking into account coronavirus expenses, the national budget projection for 2020-2021 had a $9 billion deficit. Under these circumstances, coronavirus attacked the Iranian economy on two fronts. On the one hand, it obliterated some of the expected gains, and on the other, burdened the country with astronomical prevention and treatment costs.

Our calculations show that by reducing government revenue, coronavirus will increase Iran’s budget deficit to 50%, or $17.7 billion. Additionally, the government has already pledged nearly $1 billion in aid to treat COVID-19 patients and those who have lost their income because of the pandemic. The Iranian government would need an additional $4.7 billion in resources in order to slow the spread of COVID-19 by forcing people to stay at home for one month. Otherwise, normal life will resume and the number of COVID-19 cases and deaths will continue to grow.

Revenue losses

In its proposed 2020-2021 budget bill, the Iranian government was counting on certain revenues that it will no longer happen due to the economic impacts of the COVID-19 pandemic.

In the budget, the government counts on $4.5 billion revenue from crude exports. When the budget was drafted, oil prices were $50 a barrel. But as the COVID-19 outbreak started in China, oil prices began to slip. The current price of Iranian crude is $20 a barrel which means Iran would have to sell 800,000 barrels a day to hit its $4.5 billion budget goal. We do not know the exact volume of Iranian crude sales because of the sanctions but estimates put exports at around 1/3 of this amount. Therefore, given the new price of crude, to hit its $4.5 billion goal, either the Iranian government has to triple oil sales, or the value of the dollar or Iran’s national currency must increase by threefold.

It is estimated that the government is losing $6.7 million in revenue daily due to the coronavirus-driven drop in fuel consumption–particularly during the Persian New Year (Nowruz) holiday when fuel consumption is usually at its highest.

The coronavirus has also brought the tourism industry and its related sectors such as air, rail, and coach services to a screeching halt. The government’s anticipated revenue from departure tax–which would typically see a considerable increase due to Iranians traveling abroad during the Nowruz holiday–has also been affected. Our estimates show that the country will also lose at least $3 billion in revenue from foreign visitors (which was about $11 billion last year).

In addition to the aforementioned, there are three other sources of revenue that will be lower than expected, but as there are still 11 months left in Iran’s current fiscal year, an accurate estimate of losses is impossible.

This year’s $35.5 billion budget had projected a $14.8 billion in tax revenue which is 30% higher than last year. The International Monetary Fund projected Iran’s economic growth rate would be 6- this year. Increasing taxes by 1/3 in an economy that has shrunk compared to last year seems impossible. Especially at a time when other countries fighting COVID-19 are offering businesses tax deductions and exemptions to prevent a recession.

The Iranian government was counting on the sales of government bonds as another source of income for its 2020 spending. $16.3 billion in treasury bond and properties will be sold this year to support government spending. The value of property sold by the government will be 10 times the amount of last year’s budget. However, considering the deep recession on the horizon it is highly unlikely that demand for buying buildings, factories and government bonds will remain at the same level as last year, let alone increase. The government’s only option to cover its deficit will be to sell physical assets below market value and offer bonds with a higher interest rate than banks. In other words, to fill its budget gaps the government has no choice but to auction off public assets and guarantee higher interest rates for bonds, leaving the next administration in massive debt.

The global recession will reduce demand for Iranian exports as for other countries. In March, when the coronavirus crisis pushed the Chinese economy to the brink, the value of Iranian exports to China dropped by 30% compared to the same period the previous year. When the open-market rate of the US dollar jumped last year, those Iranian products that were less reliant on imported raw materials and required higher energy consumption to produce were more favorable for export. Cement, steel, and petrochemical products were the main exported items during this period with petrochemicals accounting for more than half of the country’s annual exports. The economic growth of China, Iran’s main trade partner, is projected to decelerate to its slowest pace since 1990. Therefore, reduced demand will make achieving the same export revenue as last year impossible for Iran. Less exports reduce the amount of foreign currency injected into the Iranian economy, which means less imports and less revenue from customs duty for the state.

An academic study estimates that the coronavirus crisis has reduced the production of 63% of Iran’s industries. “According to findings by Iran’s Ministry of Cooperatives, Labor, and Social Welfare, about 20% of the workforce i.e. 4,800,000 jobholders face unemployment or a major reduction in work hours. Nearly 54 different service and production jobs will be affected by the recession resulting from the coronavirus and added value in the Iranian economy is headed toward a 9% loss. These circumstances can increase Iran’s current budget deficit from $9.6 billion by twofold, meaning half of the country’s fiscal budget. This is a terrifying figure and without injecting new resources into the economy, printing more money (which will increase inflation) will be the only way to cover it. This projection does not include the cost of treating COVID-19 patients and keeping people at home.

Incurred Costs

In addition to lost revenue, the coronavirus crisis has placed a heavy burden on the Iranian economy and created unexpected expenses for treating COVID-19 sufferers as well as pressure to reduce the effects of a recession.

For instance, the government pledged to give some four million families without a stable income such as taxi drivers, bus drivers, minibus drivers, gypsy cabs, street vendors, and seasonal workers, two-year loans and to pay the interest. This is a $187 million financial obligation for the government in 2020 and 2021.

The government has also pledged $5.5 billion in loans to businesses impacted by the coronavirus. The Central Bank of Iran (CBI) set the interest for these loans at 12%. In other words, the government is forcing banks to use the savings of their customers to give lower interest loans to certain individuals. As the interest rate on loans was 18% last year, granting these loans would mean a 6% loss for banks. The repayment of these loans has also been delayed for three months which means a half billion-dollar loss for banks.

The government has paused payments on zero interest loans for three months. Zero interest loans make up 6% of the total loans granted and a three-month grace period–without late fees–on loan payments translates into banks losing $155 million in revenue from the transaction fees.

Additionally, the government has delayed natural gas bill payments for three months. This deferment will cost the government at least $11.6 million.

Additional funding for the healthcare sector since the beginning of the coronavirus outbreak continues in Iran. In the four months from March to June, all donations by individuals and institutions toward providing equipment and other necessary items for government hospitals are considered tax deductible.

In one instance, the Planning and Budget Organization of Iran gave the Health Ministry $267 million for the prevention and treatment of coronavirus. Another $39.3 million was given to the national coronavirus taskforce, $30 million was granted to medical universities in Tehran and $35.6 million was granted to other medical universities across the country. Add to this $14.8 million in bonuses to medical staff and $22.2 million in claims by contractors working with universities. The country’s emergency services also received $7.4 million to purchase more ambulances.

The Iranian President has talked about allocating $370.3 million to insurance funds of the $1 billion withdrawn from the National Development Fund to fight the coronavirus pandemic. He also talked about giving the Rial equivalent of $10 billion in loans to businesses affected by the pandemic without revealing what the source of the relief package would be. It is believed that a part of this $10 billion pledge (approximately 28% of the government’s budget for one year) is in the form of ex gratia payments as well as packages for low-income families struggling due to the pandemic.

In addition to the above-mentioned expenses, there are other expenses by public organizations that are unrelated to or outside the government. Although these expenses will not put an immediate strain on the budget, spending revenue that has not been earned yet or taking a chunk of these organizations’ revenue expenditures will affect the economy in the form of budget deficit or reduced revenue in the near future. For instance, it is unclear how much of the increasing coronavirus-related healthcare expenses are covered by the funds allocated so far, regardless of their economic implications. There are no reliable statistics regarding the number of overnight stays in hospitals or the number of beds occupied by COVID-19 patients. We don’t even know the overall number of people hospitalized.

Based on the statistics from different provinces, about 70,000 people have been hospitalized for showing coronavirus symptoms or have been placed under care. The median cost of caring for a COVID-19 patient in the ICU is about $333 and $148 in regular wards. Insurance companies pay 90% of the hospital expenses for these patients. If only 20% of these cases require ICU stays, we can estimate that there were $1.11 million in new insurance claims in the first six weeks of the coronavirus outbreak. Another example is the 28 temporary hospitals set up by the army which will add 15,000 beds. Add to this the daily cost of producing 13,000 packages of disinfectant valued at $37,000 and 76,000 Nano masks valued at $74,000.

A Nationwide Stay-at-Home Order: How Much Does It Cost for One Month?

We can add more detail to the financial burden forced onto the Iranian economy as a result of the coronavirus pandemic. For instance, the late fees associated with goods and services that the government has deferred. While such solutions regarding natural persons (employees) and/or businesses have reduced the probability of employee layoffs and bankruptcy, or at least delayed it, it is unlikely that it will convince people to stay home. The approaches used by countries like Italy show that keeping the population at home, even for a month, would require transfer payments and forgiveness of people’s debts to government institutions on a bigger scale.

The Iranian government never placed a complete, state-wide quarantine on its agenda. We can calculate how much Iran would have had to spend to force people to stay at home for one month. The Iranian government’s refusal to enforce this policy despite repeated calls from public health officials most likely stems from the fact that it does not have the financial resources to do so.

If we base the government’s projected tax revenue in the current fiscal year–as is the norm–on receiving 60% of taxes in the first two quarters of the year, one month tax forgiveness, which means employers would not need employees to work, would cost the Iranian government $1.5 billion. So far, only some taxpayers have been given a three-month extension, but no taxes have been forgiven.

Social Security premiums are another important obligation for the 1.4 million employers and business owners which they must pay every month. One of the most effective tools to force businesses to stay closed, is having the government pay premiums for both workers and employers for one month. Last year Iran’s Social Security Organization’s $8.1 billion revenue came from insurance premiums and its companies (which amid efforts to control population movement are now mostly closed for business). This means that in order for employers and workers to not have to earn money to pay their premiums for one month the government must give the organization $666.7 million. And this does not even include the 3.5 million workers who have no record with the Social Security Organization and insurance premium forgiveness will have no effect on their staying home. The only way to help these workers would be direct payments by identifying low-income groups.

After tax and insurance premiums, pausing payments on services exclusively offered by the government would be the most critical measure to encourage people to stay home and not go to work. These services include utilities such as water, power, gas, landlines, and cell phone bills as well as taxes levied and collected by municipalities on businesses. We have estimated the cost of these services in the table below.)

Deferring or forgiving rent and loan payments are two other measures adopted in major cities across the globe to encourage people to stay at home. About 40% of urban dwellers in Iran are renters i.e. 24 million people or 7.2 million families. Each family lives in an, on average, 98 square meter (1,054 square feet) unit and pays $74 in rent. So, one month rent for all urban dwellers in Iran comes to a total of $530 million. Delaying rent payments for one month and providing it by the banking system would cost the government at least another $8 million.

Forgiving loan interests for one month would place an even heavier burden on the government. According to CBI statistics in December 2019, a total of $128.9 billion in loans were granted. Considering the minimum 18% interest rate, the total monthly interest on loans comes to $1.9 billion.

The government has shown no interest in paying or forgiving these interests (at least with regards to state-owned banks). So far only zero interest small loan holders have been given a three-month grace period.

Based on all of the above, we can approximate that the cost of keeping the population at home for one month would total a $4.67 billion financial burden for the country.

Recent Comments